food tax in maryland

02333gallon tax in Garrett County. It can be expensive to take on loans and some may not be able to raise enough money to start a large food business.

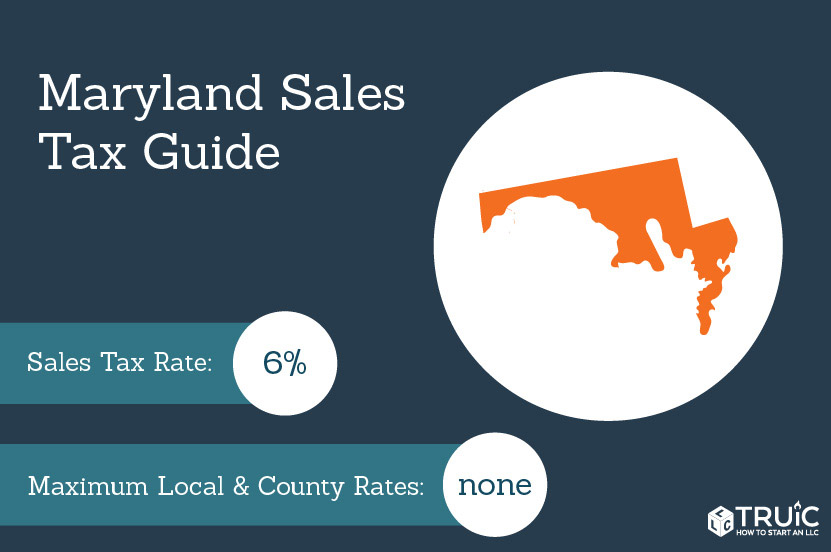

Maryland Sales Tax Small Business Guide Truic

We include these in their state sales.

. There are a variety of ways to file an application for the Supplemental Nutrition Assistance Program SNAP benefits. The new center will serve as an additional facility for food recovery and donations operations. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland FoodBeverage Tax.

A cottage food business can allow them to start out slowly without a lot of start-up cash on hand. The Maryland Cottage Food Law is based on COMAR 10150302 and COMAR 10150327. Is the food taxed here in Maryland.

Call your local office or the Maryland SNAP hotline to learn more. For example if I go grocery shopping will there be a tax rate. How are Sales of Food Taxed in Maryland.

Non-profit status 501 c 3 as described by the IRS Federal tax-ID number. You might have to join a treatment program or take drug tests. You may ask for it in person Read the Rest.

You might also face a temporary disqualification period. In Maryland this type of tax is called the Sales and Use tax and. Back to Maryland Sales Tax Handbook Top.

All sales of food and beverage are subject to the tax except the following cases. This is why you wont have to pay a Maryland food tax on a box of crackers. The rate in Maryland is currently set at 6 but not everything falls into the taxable category.

A cottage food business or a home-based business is defined in the Code of Maryland Regulations COMAR 10150 3 as a business that a produces or packages cottage food products in a residential kitchen. California 1 Utah 125 and Virginia 1. However if a grocery store that falls under this category sells prepared foods that can be consumed on the premises or carried out then you will most likely pay a 6 sales tax.

You may be wondering what the percentage rate is when it comes to the food sales and use tax and what that tax rate covers. 53 rows Table 1. Code Tax-General 11-206.

A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency. Sale of candy or confectionery.

Maryland Beer Tax - 009 gallon Marylands general sales tax of 6 does not apply to the purchase of beer. Sale of beer wine and distilled spirits for OFF PREMISES consumption. If youre eligible for food stamps Maryland wont disqualify you because of a drug felony.

You may file an application online at myDHR. In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream. How is food taxed.

Cottage Food Laws in Maryland. Additionally local departments of social services will give or mail you an SNAP application on the same day you ask for one. Vendors should multiply their gross receipts by 9450 percent before applying the 6 percent rate to determine the tax due on gross receipts derived from vending machine sales.

Cutting Wednesday afternoon of the new Food Recovery Center of Nourish Now a nonprofit food bank in Rockville. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland Meals Tax Restaurant Tax. Grocery Food EXEMPT Sales of grocery food are exempt from the sales tax in Maryland.

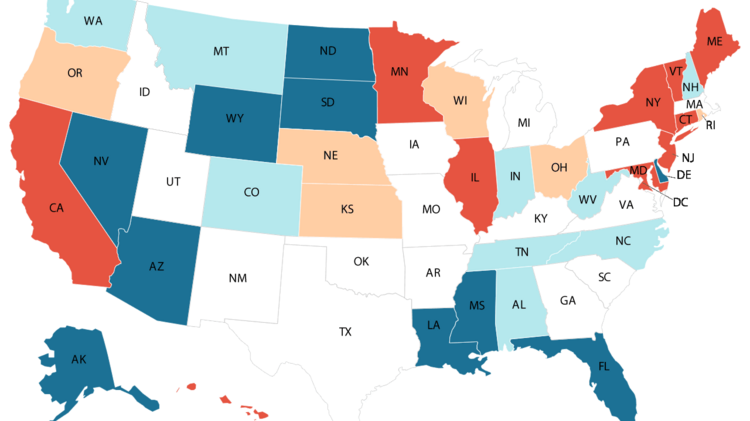

Since 2011 the food banks mission is to address food waste and food insecurity in Montgomery County. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

Made by a cottage food business that is not subject to Marylands food safety regulations. Preston Street Baltimore Maryland 21201 6 St. In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and the food is not a taxable prepared food.

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. B Three states levy mandatory statewide local add-on sales taxes. Does anyone know what items arent taxed here.

The sales and use tax does not apply to sales of snack food items by a. And b has annual revenues from the sale of cottage food products in an amount not exceeding 25000. Groceries and prescription drugs are exempt from the Maryland sales tax.

2022 Maryland state sales tax. It collects surplus food. Counties and cities are not allowed to collect local sales taxes.

Understanding the Maryland Sales and Use Tax. It is meant for businesses. Food and Beverages FAQs.

Heres what you should know. Distribution of information to constituents on the earned income tax program food stamp program and other such. However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a 6 sales tax.

Agreement to abide by MEFP guidelines such as submitting requested reports and receipts. In Maryland beer vendors are responsible for paying a state excise tax of 009 per gallon plus Federal excise taxes for all beer sold. Exact tax amount may vary for different items.

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. Paul Street Suite 1301 Baltimore Maryland 21202 410-767-6742 Fax 410-333-5995 410-767-8400 Fax 410-333-8931. In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by a person operating a substantial grocery or market business and is not a taxable prepared food.

TAXABLE In the state of Maryland any voluntary gratuities that are distributed to employees are not considered to be taxable. A Provider must have.

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Exemptions From The Maryland Sales Tax

The World Is Full Of Conflicting Advice About Food Here S How To Make Sense Of It Food Ads Vintage Recipes Retro Recipes

Maryland Sales Tax Guide And Calculator 2022 Taxjar

States With Highest And Lowest Sales Tax Rates

Pin By Betty Schmidt Guisinger On Low Carb In 2022 Maryland Style Crab Cakes Car Colors Rogue Car

Sales Tax On Grocery Items Taxjar

Tersiguels Restaurant In Ellicott City Ellicott City Maryland Ellicott City Ellicott City Md

Maryland Sales Tax Free Week 2015 When What Qualifies School Essentials Tax Free School Diy

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

Antique Beer Labels Old Beer Cans Wine And Beer

In Home Aides Services Maryland Department Of Human Services State Parks Maryland Homeowner

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Maryland Tax Credits Southern

Charles County Maryland La Plata Map Spa Day Custom Tattoo Esthetics

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Nonprofit 501 C 3 Articles Of Incorporation How To Write With Sample Non Profit Writing Articles